RPA in Finance & Accounting

Sep 27, 2016 05:23

CEO's and CFO's are constantly looking for new ways to improve and transform the financial department to improve the efficiency and add greater value to business, in a very competitive environment. Robotic Process Automation is a life-saving solution in the case of F&A because of the high number of the Full-Time Employees involved in performing manual, strictly rule-based processes which are time-consuming and highly error-prone, due to high volume data input.

RPA allows simple and accurate back-office automation which can be deployed very fast, cost just a fracture of an offshore FTE and gives an opportunity for financial shared service companies to change their focus on delivering higher-value services which require human judgment, skills, and experience. In this article, we will look at a scenario that can help leverage the acceleration of the ROI from applying Robotic Process Automation.

● Procure-to-Pay

● Order-to-Cash

● Record-to-Report

● Tax management

● Period-End close automation

Those are structured and very routine tasks that need access to multiple systems. Robots can get access to those systems and perform at higher speed with higher precision and accuracy than humans and free up your human resources time to bring more value by focusing on business-critical tasks.

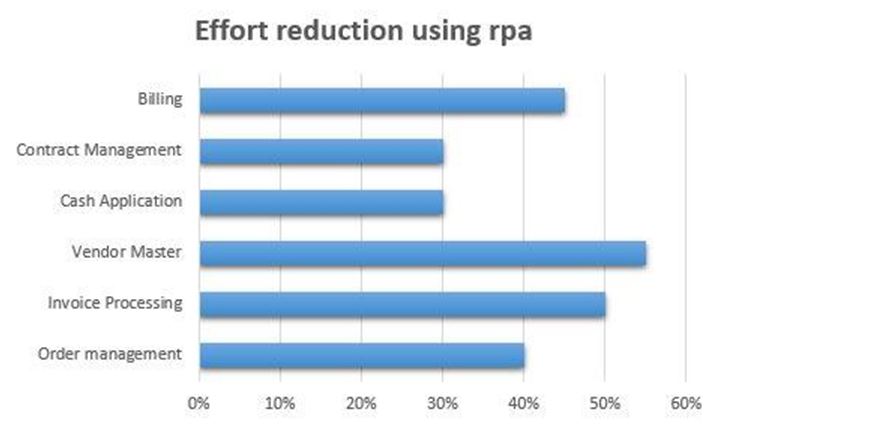

Studies shows that using Robotic Process Automation Software in cross-system processes such as reporting, invoice reconciliation, invoice processing, data gathering and matching can bring major effort reductions. As an example, a tricky account closure process can be used. It requires several people to do time-consuming reconciliation of data from multiple systems. Thanks to Artificial Intelligence and the usage of semantic reasoning robots can make fast and pretty complex decisions 24/7/365 and significantly reduce the account closure time. Based on the ACCA report, NHS trust's month-end-closure process took them 15 onshore employees and 12 days, after the Robotic Process Automation, it takes only hours and two peoples.

● The Bottom-up

The first approach is all about eliminating pain points in business processes. If You know that procure-to-pay process takes just too much time and is the bottleneck of your financial department then the process-specific robots will be programmed and deployed. Additional robots can be created later on in pursuit of a more efficient workflow.

● The Top-Down

The second approach is all about developing process-specific robots across all departments, regions, and customers to achieve maximum back-office automation. This approach requires considerable cost involvement in robotics development and be applied to simple and complex data entry and rule-based tasks in the transactional processes.

● The Hybrid

This is considered the most efficient scenario and it offers the highest return on investment. Here are two examples of a hybrid model:

Invoice Processing - Data Input

Invoice Exceptions - Rule-Based Decision

Issue Reolution - Rule-Based Decision

Payment Run - Rule-Based Decision

Travel and Expense Management - Data Input

Reconciliation - Rule-Based Decision

Customer Master - Data Input

Credit Management - Rule-Based Decision

Billing Data Input

Cash Application Rule-Based Decision

Collection Judgment-Based Decision

Robotic Process Automation is a stimulant for the business process conversion. It is one of biggest forces right now delivering benefits such as process efficiency, cost savings, and increased financial control. With the new addition of artificial intelligence the financial function gets the ability to process a larger volume of operations, use less FTE's and develop a better price model.

RPA allows simple and accurate back-office automation which can be deployed very fast, cost just a fracture of an offshore FTE and gives an opportunity for financial shared service companies to change their focus on delivering higher-value services which require human judgment, skills, and experience. In this article, we will look at a scenario that can help leverage the acceleration of the ROI from applying Robotic Process Automation.

RPA in Finance and Accounting: Why it makes sense?

The first thing that comes to mind, when thinking about F&A transactions is a rule-based, large-scale data entry and validation. Despite all the effort and investment in traditional automation, there are still gaps that only RPA can fill in due to using data from multiple non-integrated systems. Thanks to machine learning capabilities, artificial intelligence and ability to replicate the actions of a human, RPA can automate end-to-end processes such as:● Procure-to-Pay

● Order-to-Cash

● Record-to-Report

● Tax management

● Period-End close automation

Those are structured and very routine tasks that need access to multiple systems. Robots can get access to those systems and perform at higher speed with higher precision and accuracy than humans and free up your human resources time to bring more value by focusing on business-critical tasks.

Studies shows that using Robotic Process Automation Software in cross-system processes such as reporting, invoice reconciliation, invoice processing, data gathering and matching can bring major effort reductions. As an example, a tricky account closure process can be used. It requires several people to do time-consuming reconciliation of data from multiple systems. Thanks to Artificial Intelligence and the usage of semantic reasoning robots can make fast and pretty complex decisions 24/7/365 and significantly reduce the account closure time. Based on the ACCA report, NHS trust's month-end-closure process took them 15 onshore employees and 12 days, after the Robotic Process Automation, it takes only hours and two peoples.

Different Approaches

As a rule, RPA is deployed following three scenarios:● The Bottom-up

The first approach is all about eliminating pain points in business processes. If You know that procure-to-pay process takes just too much time and is the bottleneck of your financial department then the process-specific robots will be programmed and deployed. Additional robots can be created later on in pursuit of a more efficient workflow.

● The Top-Down

The second approach is all about developing process-specific robots across all departments, regions, and customers to achieve maximum back-office automation. This approach requires considerable cost involvement in robotics development and be applied to simple and complex data entry and rule-based tasks in the transactional processes.

● The Hybrid

This is considered the most efficient scenario and it offers the highest return on investment. Here are two examples of a hybrid model:

Procure-to-Pay Automation

Vendor Management - Data InputInvoice Processing - Data Input

Invoice Exceptions - Rule-Based Decision

Issue Reolution - Rule-Based Decision

Payment Run - Rule-Based Decision

Travel and Expense Management - Data Input

Reconciliation - Rule-Based Decision

Customer Master - Data Input

Order Management Automation

Order Management - Data InputCredit Management - Rule-Based Decision

Billing Data Input

Cash Application Rule-Based Decision

Collection Judgment-Based Decision

Robotic Process Automation is a stimulant for the business process conversion. It is one of biggest forces right now delivering benefits such as process efficiency, cost savings, and increased financial control. With the new addition of artificial intelligence the financial function gets the ability to process a larger volume of operations, use less FTE's and develop a better price model.