Challenges and Opportunities in Modern Banking Software

Feb 22, 2024 21:40

Modern banking software finds itself at a pivoting point as rapid technological advancements shift consumer expectations. So, new advances bring both prosperity and challenges. A challenging environment puts banking software in a situation where they must leverage the market conditions to stay relevant.

However, if you want to thrive in the modern era of banking software the understanding of both opportunities and challenges is the starting point.

Challenges

So, let’s start with the most daunting part. Figuring out the challenges of current banking software development will make it easier for you to move about the competitive market.

Cybersecurity Threats

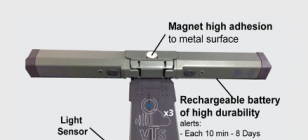

Cybersecurity threats have become a major concern for financial institutions since the digitization of banking services. Cyberattacks target sensitive customer data, financial transactions, and digital assets. This turns them into a significant risk to the integrity and reputation of banks. Cybercriminals continue to leverage their tactics, so banks must invest in robust security measures.

S-Pro recommends reviewing such methods as encryption, multi-factor authentication, and continuous monitoring. They will help safeguard against breaches and protect customer trust.

Legacy Systems Integration

Legacy systems often lack the flexibility and interoperability required to support modern digital banking services. This makes them slower and prompts many banks to turn their heads towards new systems.

However, integrating new banking software solutions with existing infrastructure without disrupting operations might be challenging. One downside of this process could be compromising data integrity.

Regulatory Compliance

This is a top priority for banks. As always, there are stringent requirements regarding data privacy, anti-money laundering (AML), and Know Your Customer (KYC) procedures. Thus, compliance with evolving regulations can present a significant challenge for banks. It requires them to adopt robust risk management practices, implement comprehensive compliance frameworks, and stay abreast of regulatory updates. All of these demand resources and time, which in turn make compliance complicated.

Customer Expectations

An average modern customer needs more personalized experiences. Meeting these expectations often requires banks to leverage advanced analytics, artificial intelligence (AI), and machine learning algorithms. This, in turn, is pricey and complicated; and might also take months to deliver.

Opportunities

Now, moving on towards the opportunities in the industry. This will help you achieve all you want and require in the industry. All you have to do is leverage these opportunities in your own favor.

Digital Transformation

There are numerous opportunities for banks with digital transformations. Among them are streamlining operations, enhancing efficiency, and improving customer experiences.

Open Banking

Open banking initiatives empower banks to securely share customer data with third-party providers. Usually, APIs would be used for that. Open banking fosters collaboration with fintech startups, expands their product offerings, and creates new revenue streams.

Personalization and Customer Experience

Personalization is key to winning customer loyalty, which responds directly to their primary pain point. Data analytics and machine learning algorithms can provide banks with deeper insights into customer’s preferences, behaviors, and life events.

Concluding all that’s been said, the challenges and opportunities in modern banking software underscore the need for banks to embrace innovation. Competitiveness in the market forces many businesses to agility and new technological advancements. Hence, if you’re having any troubles with adopting new tech, get in contact with S-Pro. Their experts and extensive experience will help you leverage the competition and upscale your fintech software.