Bitcoin transfers: What can be known about the value of old coins?

Oct 22, 2020 20:25

The crypto markets encountered a low thundering sound recently as an antiquated section of 50 Bitcoin, mined only a month after Bitcoin was made and now worth some US$450,000, arose from its sleep. The chunk rose up out of the earth and rose into the air, at that point divided into two pieces, every one of which grew a couple of wings and travelled to another perch in an alternate wallet.

In 2009, a transaction took place with the bitcoin that was mined and till now that is unblemished. Now there’s only one thing which is going around in everyone’s mind and that is whether Satoshi has returned or not. Also, the primary answer everybody got was "most likely not". The probabilistic examination of Satoshi's initial mining reveals to us that this exchange presumably has a place with some other early Bitcoin excavator.

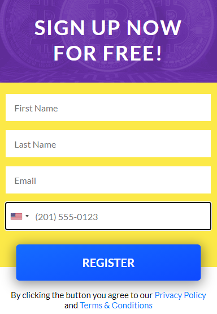

The business sectors weren't excessively consoled however and Bitcoin costs slipped lower as the news broke. Now it remains unclear if the slip had anything related to the news or if it's just an incident that has nothing to do with the news. If you want to invest in bitcoin then visit below to explore more.

Fungibility vs collectability

The main explanation everybody can assemble around this sort of occasion with their popcorn and the main explanation markets can possibly proceed onward such turns of events is on the grounds that Bitcoin isn't fungible. Fungibility alludes to when each unit of something is compatible and similarly esteemed.

Dollars are fungible, in light of the fact that every dollar merits a dollar paying little mind to which dollar it is and where it has been. Fine arts, collectibles, comic books, and activity figures are not fungible, on the grounds that their worth is subject to the individual thing's provenance and shifts relying upon whether the thing is in its unique bundling or any novel characteristics it may have. It's commonly acknowledged that any reasonable money must be fungible. In the event that it's not, it can't go about as a predictable unit of record, while its capacity to store worth and fill in as a mechanism of trade begins self-destructing.

In digital money, where all exchanges are followed on a public blockchain, the presence of modern blockchain examination apparatuses implies all cryptographic forms of money are non-fungible naturally. In spite of being absolutely advanced, each coin has a background marked by sorts and can hypothetically be followed back to its creation. The special case is security coins which, by uprightness of disguising their exchange chronicles, have become practically tradable and fungible. This is somewhat abnormal for Bitcoin in light of the fact that so a large number of its standards are tied up in the thoughts of security, fungibility, and sound cash, yet in carefully pragmatic terms it has never truly accomplished that.

Coin blenders and coin Joins as discovered coordinated into stages like Wasabi Wallet offer a level of on-request security for singular clients, however, without being revered for all on the convention level, it's insufficient to really make Bitcoin fungible. That wasn't deliberate. Satoshi Nakamoto needed it to be, yet it essentially just slumped on that front since it was too hard to even think about implementing. The inalienable polarity of blockchain protection is that all that should be completely open and straightforward for a framework to certainly affirm exchanges, yet in the event that it's open and straightforward it's not private.

All the most noticeable digital currency protection establishments, including zero information verifications, Mimblewimble, and the gathering marks that would shape the establishment of Monero, were completely proposed for Bitcoin however then wound up floating away to different cryptographic forms of money since they couldn't work with Bitcoin. These old coins springing up to give a striking token of exactly how non-fungible Bitcoin is. Also, a significant number of the reactions to the occurrence, as fears that detectives looking for Satoshi will inadvertently wind up de-anonymizing some other early digger, simply demonstrate how non-private bitcoin truly is.