Type of mortgages available in UK

Apr 13, 2018 18:16

Choosing the right mortgage can be overwhelming given the wide variety available. Picking the best mortgage rate doesn’t necessarily mean getting the best financial product. Selecting the right type is imperative in order to acquire short-term and long-term financial benefits.

All the mortgages are fundamentally the same and operate in a similar manner. Money is borrowed to purchase a property, interest is paid on the loan and is then eventually paid back. However, there are different types of mortgages available in UK and each of them is slightly different. Here is a list of some of them:

1. Fixed rate mortgage

The interest rate paid in fixed rate mortgages remain same throughout the term no matter what impacts the interest rates. These are pretty popular with first time buyers because the mortgage rate is fixed for particular number of years. It satisfies the borrower that monthly payments will remain constant helping to formulate a steady budget. However, drawback with this type is that the borrow will stuck on a higher rate when other mortgages go down. It lacks flexibility.

2. Variable rate mortgages

Every lender has a standard variable rate mortgage. This is one of the most basic mortgages offered. The mortgage rates generally change and the interest rate fluctuates. Influence is been drawn from the Bank of England, however there are other important factors as well. It is a flexible option for buyers who are looking for more than one deal. However, the rate of mortgage can change at any given point in time.

3. Discount rate mortgages

Platforms like Propillo offer discount rate mortgages. It is a reduction on the lender’s standard variable rate. These are one of the cheapest options in the market and therefore popular amongst borrowers. However, it is associated with standard rates and will fluctuate according to it. But there are some downsides as well. Lender is at complete discretion to bring changes in the rate which will have a direct impact on the discount rate as well.

4. Tracker mortgages

Tracker mortgages work in line with different interest rates - typically with the base rate of Bank of England. The actual mortgage rate being paid will be an interest rate above or below the base rate. The mortgage rate increase with an increase in the base rate and vice versa. However, these mortgages normally have a short life. It may typically last between two and five years. It is good for buyers who can afford to pay more but believes that the rate may go down.

5. Offset mortgages

These mortgages are associated with a savings account and combines mortgage and savings together. The amount owed to the lender is deducted from savings every month. The interest is paid according to the difference between these two. Your savings operate as an overpayment which assists in clearing the mortgage earlier. It is one of the most popular types good for buyers who have considerable amount of savings, especially for high rate taxpayers.

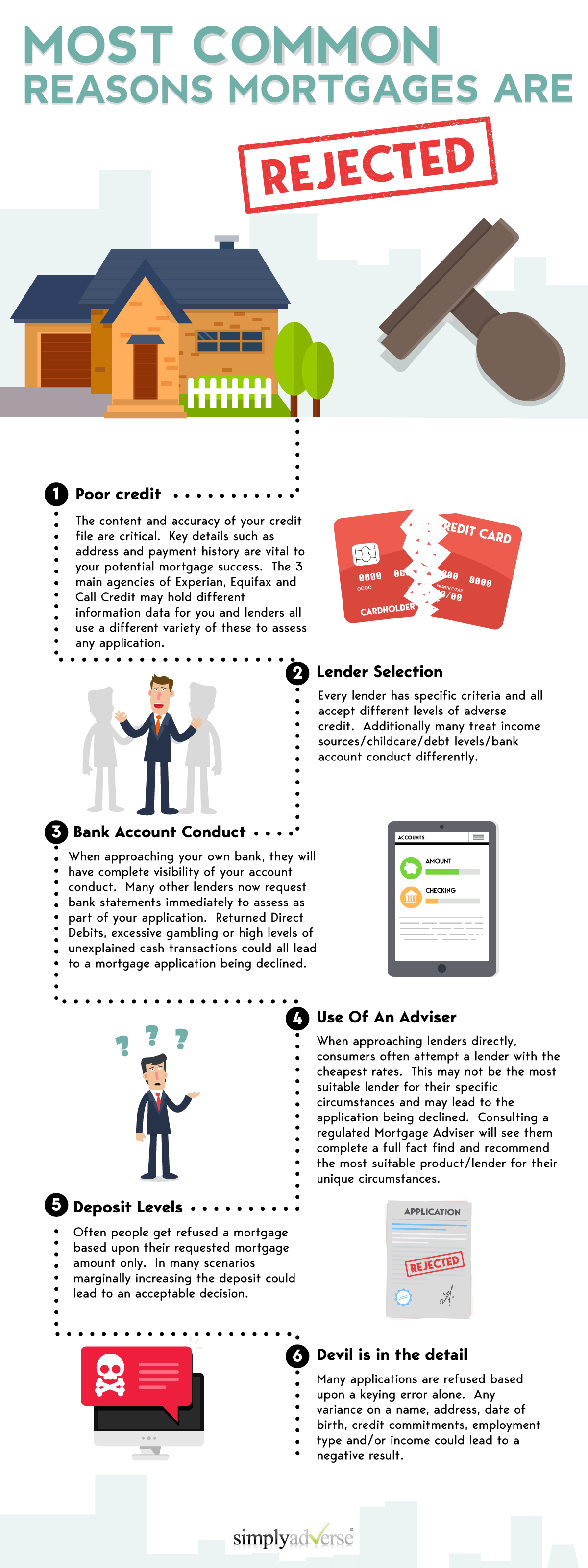

If you’d like to learn more about mortgages, check out this helpful infographic from Simply Adverse.