How Does Bitcoin and Paper Currencies Ressemble?

Sep 14, 2021 19:02

Introduction

Bitcoin's value is derived from several distinct factors. In the end, confidence is what gives both cryptocurrency and conventional currencies their worth. Money will persist in having worth as long as the structure trusts in the fiat currency system. You can argue a similar thing about Bitcoin: it has worth since people believe it does, but there's more to consider. Bitcoin, unlike fiat currency, does not have a centralized financial institution, and its autonomous nature has enabled the development of a distinct financial sector. The safety, scalability, and other advantages of distributed ledger technology are numerous. It also provides a ground-breaking method of coping with worldwide payment transactions.

Despite significant changes, Bitcoin as a virtual form of wealth has some resemblance to the paper currency we are all familiar with. Good money should satisfy supply limitation, divisibility, usability, portability, longevity, imitation resistance, and storage of wealth. Let us just look more closely at all of such traits individually. If you are interested in bitcoin trading and investment visit bitcoin trading.

1. Limited supply

The availability of money is crucial to maintaining its worth. A huge currency availability could lead to a surge in the cost of products, leading to financial catastrophe. An insufficient currency flow might also lead to economic difficulties. Financial globalization is a macroeconomic theory that focuses on the importance of currency availability in the wellness and development of the economy. Most countries around the globe seek to generate currency to manage the limitation of supply in paper currencies. Many countries have a fixed level of inflation, which lowers the worth of their paper money. For example, throughout the United States of America, the whole figure has typically hovered about 2%. Unlike Bitcoin, which does have a variable production pace that evolves over the period, this is not the case with Ethereum.

2. Divisibility

Sufficient monies can be broken down into small subunits. A unique monetary structure should be adaptable to trade throughout all sorts of products and services inside a society. The currencies have to be divisible enough to appropriately assess the cost of every commodity or service accessible across the industry. Any firm that accepts bitcoin could use it for any trade.

3. Utility

To be valid, money should have usability. Consumers should be allowed to exchange currency units for products and services consistently. One of the main reasons money emerged initially is that currency traders could prevent bartering openly for products. The usefulness also necessitates the ability for funds to flow rapidly from one place to the next. This criterion is difficult to meet with heavy valuable metals and products.

4. Transportability

To be valid, monies should be freely portable among members in an economic system. In the context of paper money, this implies that wealth units should be convertible both within a state's economy and across borders via trade exchanges.

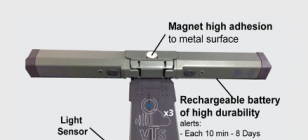

5. Durability

Money should be, at minimum, somewhat enduring to be successful. Currencies or banknotes constructed of readily mangled, broken, or ruined substances, or that decay to the extent of becoming useless over the period, are insufficient.

6. Counterfeitability

Money must be both lasting and difficult to imitate to remain successful. If not, hostile entities may quickly destabilize the financial system by overwhelming it with fake cash, lowering its worth. To determine Bitcoin's worth as money, we'll contrast it to paper money in both of the areas listed earlier.

Conclusion

Consumers choose to use Bitcoins to shop for products and commodities, save their funds, or speculate, which is the fundamental cause for its present worth. The higher Bitcoin's worth in US dollars and other monies can acquire as the community of Bitcoin customers and traders develops, and the technology evolves increasingly safe and sophisticated. Several have questioned whether Bitcoin has actual worth due to a generalized absence of knowledge and confusion. Bitcoin operates on a pretty secure site. Its members, traders, and dealers invest a great deal of trust in bitcoin.